Corporations are under political scrutiny again, as they have been periodically in American history. Also under examination is corporatism, the alliance between large favored firms and central government. While “corporatism” is easy to define - the collusion between politically connected firms and State - defining “corporation” is a little more difficult. This is because the word can refer to a broad category of human associations.

Corporations are under political scrutiny again, as they have been periodically in American history. Also under examination is corporatism, the alliance between large favored firms and central government. While “corporatism” is easy to define - the collusion between politically connected firms and State - defining “corporation” is a little more difficult. This is because the word can refer to a broad category of human associations.In its broadest sense, a “corporation” is an artificial person representing an association, which has certain legal rights that a natural person has. In particular, these legal rights generally include the right of ownership, contract, and the right to sue or be sued. When several people get together for a common purpose, they may create such an artificial entity to pursue that purpose. At this level of abstraction, a corporation’s “rights” are simply the direct extension of its members’ rights.

Notice that, using this general definition, there is no official sanction or charter for a corporation, just as there is none for most associations or groups. A corporation is created by people exercising their freedom of association. These people’s rights can be protected “in a package” by reference to their corporation.

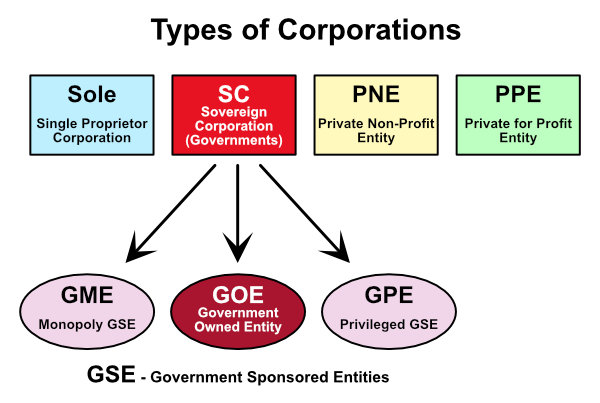

Some histories of corporations, such as the one in “Unequal Protection” by Thom Hartmann, ignore corporations’ part in history until the merchant shipping industry of the 1600s. Also, Hartmann (and others) play too loosely with the definition of “corporation,” drawing unwarranted conclusions by comparing vastly different entities. For example, Hartmann takes a GSE (government sponsored entity) with government bestowed monopoly privileges, the East India Company, and attempts to liken that to modern PPEs (private for-profit entities.) The fact that government and private entities have different incentives, rely on fundamentally different funding (political vs. economic), and have different constraints on collective conduct, doesn’t seem to occur to anti-corporationists like Hartmann.

Before continuing, let’s define one more term: “special interest.” A special interest is a group or association which attempts to promote a certain agenda or values through government power. Thus all corporations are special interests if they attempt to influence or exert political power. But not all special interests are corporations. Special interests include unions, churches, environmental groups, racial and national identity groups, and so on.

“Unequal Protection” has two major flaws. First, it construes the problem too narrowly by discussing the many problems of special interests in a democracy, but blaming these problems only on one special interest - PPEs. Second, it takes an innocuous convention - corporate personhood - and claims that it is the root of all corporatist evil. This monist scapegoating is wrong historically, and (as Hartmann all but admits) is no more than a marketing ploy. It makes for some pithy bumper sticker slogans (“Corporations are not People”), but objectively misunderstands the problem of corporatism.

Corporations, despite Hartmann’s repeated claims that they must be chartered by a government, predate formal government chartering by centuries if not millennium. Probably the first corporations were families. Land, resources, and structures could legally belong to a family, that legality being determined by local customary law. Another form of corporation, corporation sole, was a single person entity such as a parson or bishop. Land or buildings could be given to the church parson, to be inherited and used by later parsons (rather than the sons of the original parson.) Churches were often corporations, too, especially when they held real estate.

Starting in the 1600s a new type of corporation emerged: the State. Before this, governments were generally owned by a monarch or his family. The State as an independent entity/person, which outlived any particular ruler, began in earnest when government bureaucratic administrations became permanent adjuncts of rule, according to historian Martin van Crevald (“The Rise and Decline of the State.”) In terms of sheer violence-power, States remain the most powerful corporations on earth to this day. This fact puts the anti-corporation rhetoric of groups like Occupy Wall Street into perspective, and undermines their case considerably, since they favor, in essence, a transfer of power from relatively weaker private corporations to larger State corporations.

Soon the State, being the dominant corporation, was using the wealth plundered from its subjects to capitalize ventures. The State, in its mercantilist zeal, paid chosen people to increase trade by shipping goods. Since the State claimed “ownership” of the waters, not to mention the people under its dominion, it claimed the right to sell “permissions” to trade. Thus, the State created the GSE - the government sponsored entity. The Dutch had their shipping GSE - the VOC - and the British had their GSE - the East India Company.

This seminal corporatism was a two-way street. In return for venturing their capital, the GSE received monopoly privileges - usually a monopoly on trade between two countries. The Muscovy Company, chartered by England in 1555, had a monopoly on trade between England and Muscovy (Russia.) The English East India Company had a monopoly on all trade between the East Indies (including India and China) and England. The VOC (Dutch East India Company) copied the EICs government enforced cartel model, and received exclusive rights (for Dutchmen) to trade with Asia. The corporatist quid pro quo was transparent. States sold monopoly privilege to favored firms. In return the States (or its rulers and bureaucracies) received stock (outright or under favorable conditions), funding, and political support.

Observe that, though there were rare examples of private joint stock corporations earlier than that (e.g. the Bazacle Milling Company, 1250 France), corporations were largely born from State attempts at grand projects. The East India Company was a GSE, more like NASA than Nabisco. The EIC was created by England to win the Asian trade race, in much the same way NASA was created by the USA to win the space race. To avoid confusing very different types of corporations, I offer the following typology.

- Corporation - legal “person” representing an association of people

- Sole - a single person corporation

- GSE - government sponsored entity

- monopoly GME

- privileged (non-monopoly) GPE

- govt contracts

- trade barriers

- operating barriers (licensing, regulation)

- subsidies (direct or indirect like transport/fuel)

- PNE - private non-profit entity

- PPE - private for-profit entity

- SC - sovereign corporation (modern governments)

Now that we have our definitions and typology, let me address a bizarre attempt in Hartmann’s “Unequal Protection” to redefine the term “commons.” “Commons” has two standard meanings:

1) resources that have not been claimed as property, i.e. unowned resources

2) resources which may be utilized by all people, i.e. everyone has equal use rights and no one may be barred from use

Hartmann makes up a new meaning for “commons:”

3) all resources owned or controlled by the State

The immediate reaction is disbelief and ridicule. How could someone just invent a definition so different and opposite the normal definitions? It becomes clear that Hartmann subscribes to a supernatural article of statist faith, that State = people - that a central government is (always and must be, is defined to be) the people, that the State embodies the will of the people.

This statist assumption is empirically false (even to Hartmann given the State’s decrees regarding corporate personhood) and as insubstantial as any other utopian dream. Not only is the State not the people, but institutionally the State has perverse incentives which preclude even remotely approaching that populist progressive mirage.

This attempt to expropriate the word “commons” and make it serve the State is quite self-serving. Hartmann wants the State to control all the resources humans hold dear, but saying it like would be overtly totalitarian. So he says that the State protects the commons. By equating State with people, he tries to make this sound like a good idea. In fact, it is an obvious endorsement of tyranny, the antithesis of freedom.

Corporatism was a major factor in colonial America. The Virginia Company, granted land by the King of England, originally owned what became the southern colonies. Hartmann points out that the Boston Tea Party threw the East India Corporation’s tea into the harbor. Hartmann tells a good story, but he got two points wrong. First, he portrays the EIC as a powerful multi-national corporation at the peak of its power. In fact, the EIC was almost bankrupt due to mismanagement and mass starvation in Bengal, a company province. The only reason EIC remained solvent was a bailout by the English Parliament (many of whom owned stock.) Bailouts to crony corporations are nothing new! The second thing Hartmann got wrong was his equivocation of this government chartered monopoly GME with modern private PPEs. Hartmann’s claim that people back in colonial times were anti-corporate is an anachronism. People back then, better than Hartmann, knew that EIC was a creature of the English State. Their argument was with parliament and/or the king, including the monopoly privileges they bestowed. The colonists were for free trade - the right to trade with French, Dutch, or Spanish people. They weren’t against corporations, only monopoly corporations.

As we know, both land corporatism (e.g. the Virginia Company) and tea corporatism (EIC) failed in colonial America. The Virginia Company soon sold what land it could and disbanded; the Boston Tea Party ended tea corporatism (though EIC opium corporatism troubled Asia.) In the 1800s, state and local corporatism generally failed miserably in the US. Today we would call the various government canal, road, and rail schemes “corporate subsidies,” but then they were euphemized as “internal improvements.” The corruption and theft got so bad that several states amended their constitutions to disallow any money going to private firms.

The champion of corporatism in the early US was Alexander Hamilton, who attempted on behalf of government and bankers to take over an important control point of society - money and banking. Hamilton set up the US government’s first banking corporation, a central bank. But due to corruption and unpopularity it eventually failed. Andrew Jackson put it out of business.

Corporatism reared its ugly head again when New York gave Robert Fulton a thirty year monopoly on steamboat service. A New Jersey steamboat man, Thomas Gibbons, hired a young man named Vanderbilt in 1817 to run a pirate steamboat service. Vanderbilt managed to lower fares to well under the monopoly price and also elude the law. This started a career for Vanderbilt, who made a fortune by out-competing subsidized or monopoly “political entrepreneurs” (as Burton Folsom calls them in “The Myth of the Robber Barons.”)

It is in his comparison of these early monopolistic corporations and modern PPEs that Hartmann makes a major error. What Jefferson opposed (in numerous quotes Hartmann gives on p.70-71) is government granted monopolies. Jefferson wants “restriction of monopolies,” “freedom of commerce against monopolies,” and “no monopolies in commerce.” He mentions monopolies every time, but doesn’t mention corporations. Yet Hartmann attempts to construe this as being anti-corporation rather than anti-monopoly.

Up until the War of Northern Aggression, freedom of trade had overcome attempts at what would come to be called “corporatism.” The two attempts at statist takeover of society’s control points had been blocked - the Hamiltonians’ central banking scheme and the attempt to monopolize the new steamboat transportation technology.

But as Bourne famously wrote, “War is the health of the State.” The War of Northern Aggression changed everything. A railroad lawyer who backed “The American System” of high tariffs, central banking, and corporate subsidies, became president, his election financed by railroad bosses. During and after the war, Lincoln gave land and cash subsidies to various crony railroaders. Needless to say, the process was corrupt and inefficient. Receivers of railroad subsidies tended to “mine” the government for cash and land rather than planning an efficient railroad. Both major firms that built the notoriously corrupt and shoddy transcontinental railroad went broke. Meanwhile, the meticulous James Hill built a transcontinental railroad without a cent of government subsidy nor any land grants. And his railroad thrived!

But the damage was done - after the war the new powerful central State was not to be denied. The Interstate Commerce Act corporatized the railroads, and the contagion spread to the whole transportation industry. Statists don’t like to admit failure in the face of evidence. Failure of government policy, for the true believers, simply means that more money and enforcement should be applied. When trucking made the commerce regulations obsolete, the corporatist State-CronyRR alliance applied the outmoded regulations to trucking instead of repealing them for railroads.

Railroads had failed repeatedly to fix prices in the early 1800s. There is a logical reason for this related to game theory. A cartel is an n-person “prisoner’s dilemma game.” When a cartel fixes a price above the market price, then every member of that cartel has a strong temptation to cheat. It is “individually rational” to defect in such a game. And sure enough, no one was able to fix prices for long. The temptation to sell unused freight capacity “under the table” was too much. But the government stepped in by creating a cartel enforcement board, euphemistically called a “regulatory agency,” in this case the Interstate Commerce Commission. Suddenly, with the aid of government police power, price-fixing cartels could be enforced by fine and prison.

This clearly took some propagandizing! How do you convince the public that low prices and competition are bad? How do you convince them that price-fixing is good, at least when done by State rulers? Answer: Call it “cut-throat pricing” instead of “everyday low prices.” Make up safety issues as a cover for cartel enforcement. And it worked! The dupes of the day were the original “progressives,” whose intellectual descendants still see the unholy collusion of State and connected firms (“regulation”) as a good thing.

Thus commerce was captured by corporatism. Next to be captured: money and banking again. During the War of Northern Aggression the issuance of greenbacks, a fiat currency, and enactment of numerous banking regulations paved the way for total nationalization of central banking in 1913. Instead of fixing rail freight rates, “political” banks needed to fix the rate of inflation for the notes they issued. After all, creating money out of thin air by lending was a lucrative business when you could get away with it. Prior to the war, banks that had too low a reserve - or had inflated their notes too much which amounts the same thing - would risk other banks (and customers) demanding redemption in gold (or silver.) Thus, banks that inflated too much were driven out of business. But what if all the banks inflated at about the same rate? Then the problem of redemption would be gone. But of course some banks felt an obligation to serve their customers and not distribute worthless unbacked paper, or take on so much risk. The 1913 Federal Reserve Act took care of that problem by enforcing a banking cartel - “regulating” dangerously low reserves uniformly. Since then, the dollar has lost 98% of its value, and is no longer redeemable in silver or gold or any commodity. What value it has is based on the State’s future ability to plunder its subjects and/or capture resources through military aggression.

It is events like the foregoing - the State cartelization of railroads and banking that constitute the benchmark events of US corporatism. Hartmann’s preoccupation with a trivial event, the 1886 Santa Clara County vs. Southern Pacific decision, is not due to any objective significance. The emphasis on Santa Clara and corporate personhood has mainly to do with marketing. The Santa Clara decision, Hartmann admits, had no immediate effect on corporations, and indeed the non-decision about corporate personhood (the offending part was merely in the headnotes and has no legal status) was barely noticed for decades. Hartmann even admits in his book that repealing corporate personhood would do nothing in itself except “allow the real work to begin.” He claims that the “vital work” cannot be done until Santa Clara is reversed, but does not back this up. He does not say what the vital work is, but I surmise that he would approve of local restrictions on freedom of trade for PPEs. Of course, how one could do this without violating individuals’ freedom of trade is problematic.

Might I suggest another solution that violates no rights: banishment with cause? Hartmann wants to protect local citizens by disallowing corporate activity, but he admits that not all corporations are bad. Then why attempt to enact preventative laws which almost certainly violate rights? Let’s take the opposite approach and embrace the notion of corporate personhood. Let’s banish corporations that do wrong from our towns, counties, and states. This is a well-known punishment with ample precedent in common law. Historically, the main objection to banishment has been that it isn’t effective. A banished thief simply moves to another town where people don’t know him. But for a corporation, banishment can be very very effective. From the local people’s point of view, it totally solves the problem. From the corporation’s point of view, it is definitely a penalty since it reduces their market and is an open record that other communities can see. Since it is with cause, the rights issues are avoided.

Another thing we can do locally is to forbid local governments from bribing corporations with subsidies, tax breaks, or TIFs. On the other hand, Hartmann’s idea of revoking charters is a non-starter. This is yet another case where Hartmann looks at early monopoly chartered corporations (GMEs) and draws invalid inferences about modern private corporations (PPEs.) Revoking a charter in Delaware would simply cause a corporation to recharter in Nevada, Canada, or Panama. It would not “force liquidation” as Hartmann seems to think.

Hartmann does point out two indisputable problems: size and externalities. Both can be addressed in better ways than appealing to the boogeyman of corporate personhood. An irony is that, while Hartmann fears and loathes the size of multinational corporations (PPEs), he seems totally unconcerned about the size of that other corporation - the one with all the violence-power - the State. If you are concerned with sheer size, then I recommend reading “The Breakdown of Nations” by Leopold Kohr for an excellent analysis. As for an immediate remedy: reduce the power of the State to subsidize, regulate, and bestow favors on crony firms.

The problem of externalities, pollution, is also serious. But again, corporate personhood doesn’t address the problem at all. Pollution is done (or not) by individuals, families, non-profit entities, GSEs, and PPIs. Why pick on just one entity instead of addressing the root issue? What we need are better property definitions. Whether government monopoly legal systems can accomplish this is debatable. But so long as decreed law allows pollution - allows some people to aggress against other people’s property - the problem will continue. Currently we have decreed law which, for example, allows people holding mining rights to damage the wells and property of those with surface rights. This violates every known principle of property. So do “forced pooling” laws. Finally, government refusal to define property rights on unowned commons (like oceans) results in both pollution and extinction. Clearly this goes much deeper than cute slogans about corporate personhood.

All in all, Hartmann’s analysis in “Unequal Protection” is vacuous and superficial. His contention that the root of all evil (pollution, poverty, unjust laws) is corporate personhood is never proved. There is a whole lot of pep-talk and salesmanship in the pretty notion, but on closer examination, corporate personhood is merely a frail scapegoat. The real problems of property definition and oversized firms are not so easily solved.